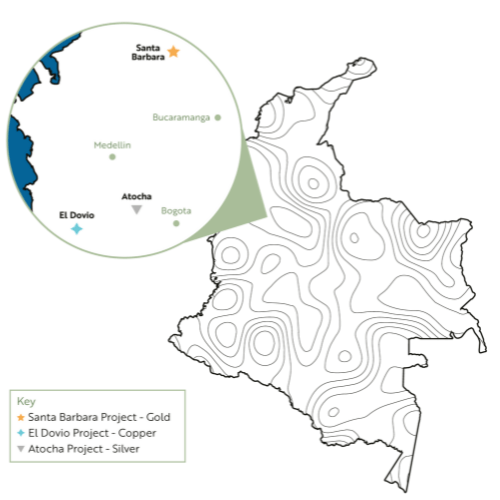

The Santa Barbara Gold Project

The recently completed takeover of the unlisted Andean Mining Limited for $7m in an all-scrip bid, meaning a 40% increase in the issued capital, has provided the Company with opportunity for both near term gold earnings and exciting blue-sky potential. A successful pilot mining operation by the previous owner treated 500 tonnes of ore that achieved the very high recovered grade of 20 gpt gold. Aguia plans to restart the 30 tpd pilot plant in Q4 of 2024, and continue to process gold mineralisation from the exploration adits. It has every expectation of being able to repeat the performance of the trial program but on a continuous basis rather than batch processing.

Once the plant has been recommissioned and debottlenecked, the next step will be to progressively expand the capacity through additional development of underground workings and capital expenditure on the plant. The budget estimates recommissioning costs of approximately A$1.5m. It should be noted that the Company is unable to provide formal guidance for the gold production owing to an absence of JORC resources.

Rather than conducting exploration the drilling work has comprised of exploration along adits that have been developed on the outcropping veins. This has provided valuable information on the geometry and rock mechanics experienced in actual mining that could not be achieved on drilling alone. It has demonstrated the consistency of the orebodies along strike of the near vertically dipping veins. Underground mining conditions are now well understood. The treatment of 500 tonnes in a CIL treatment plant has confirmed the metallurgical performance and recovered grades, substantially reducing commissioning risk.

Even though the Company is precluded from providing guidance, educated investors will be able to draw their own conclusions regarding the potential profitability of the Santa Barbara Gold Project. The Company will release production figures when they become available, based on actual results rather than predictions based on estimates and studies.

Early in 2025, Aguia will start an exploration drilling program aimed to facilitate the calculation of JORC resources. This program would be best described as brownfields exploration, rather than greenfields, because of its proximity to the underground workings. Drilling above and below the already exposed high-grade gold vein could give a quick path to a JORC resource. There are 7 km of veins to be tested in a larger exploration program.

Aguia believes that it has a mineralised gold system similar to that of Buritica, that can typically extend to depths of 1,000m and more. The Buritica Gold Mine in Colombia started out with a 30 tpd trial treatment plant 10-12 years ago, and grew to become a very large project that is now producing approximately 400,000 oz. Aguia believes it is dealing with a similar geological environment. Accordingly, it sees significant blue-sky potential that will be tested over the next few years.